spread forex meaning

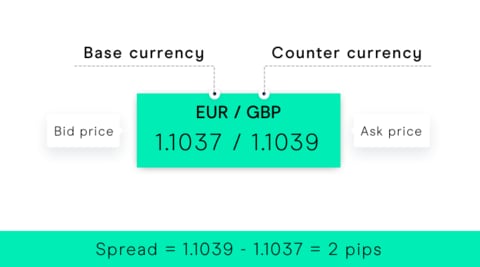

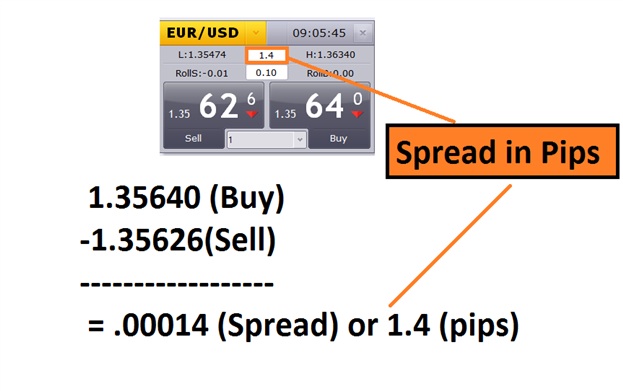

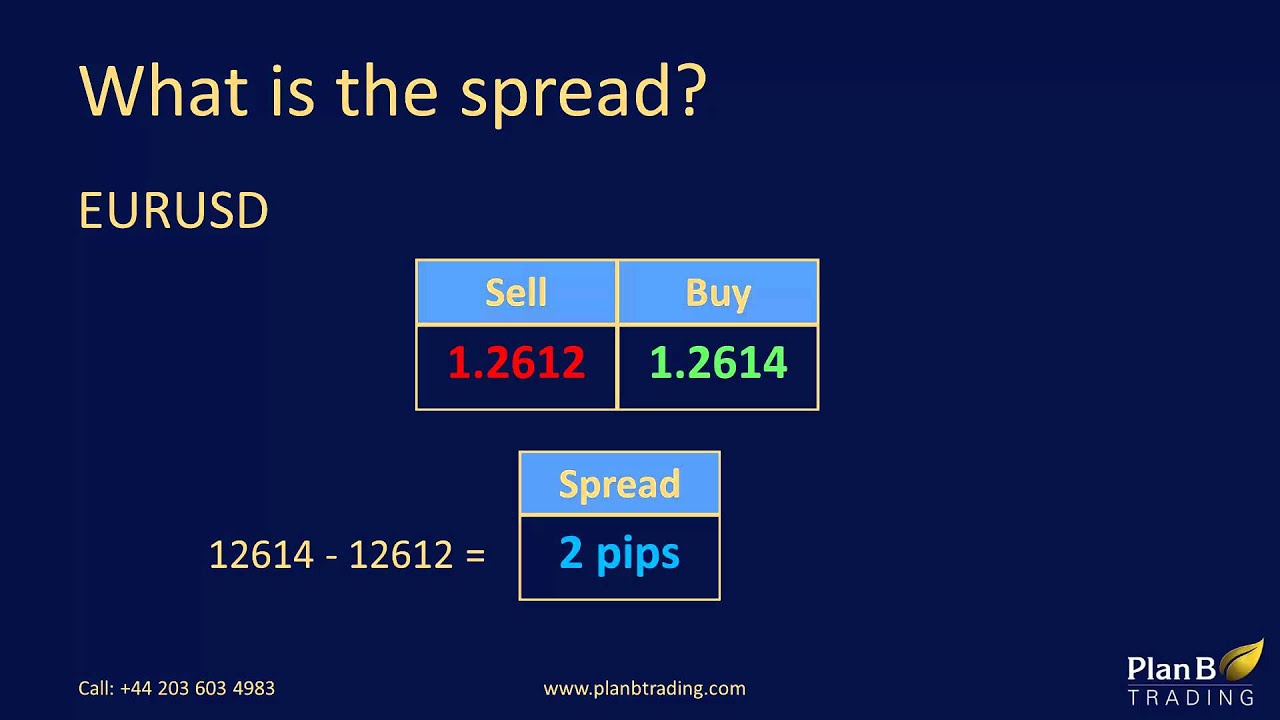

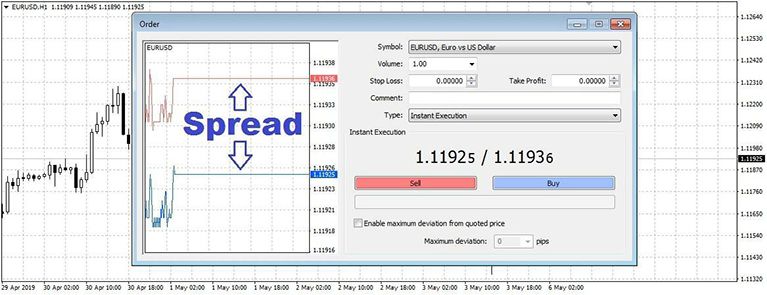

The spread is calculated using the last large numbers of the buy and sell price within a price quote. Forex spread meaning is quite simple.

Forex Spread What Is The Spread In Forex And How Do You Calculate It Ig Uk

Bid Ask Spread Pips X Lots Spread Cost.

. The ask is the price at which you can BUY the base currency. The difference between the inceptive price and the amount of money received from the resale is referred to as profit or income. This is the simplest way to understand what a spread is.

Forex spread meaning can be explained as difference of price when you want to buy or sell. Picture any form of trading such as purchasing clothes for resale or anything else that comes to mind. With online brokers the purchase price is always higher than the sale price of an asset meaning that if you opened a position and closed it straight away you would make a loss exactly.

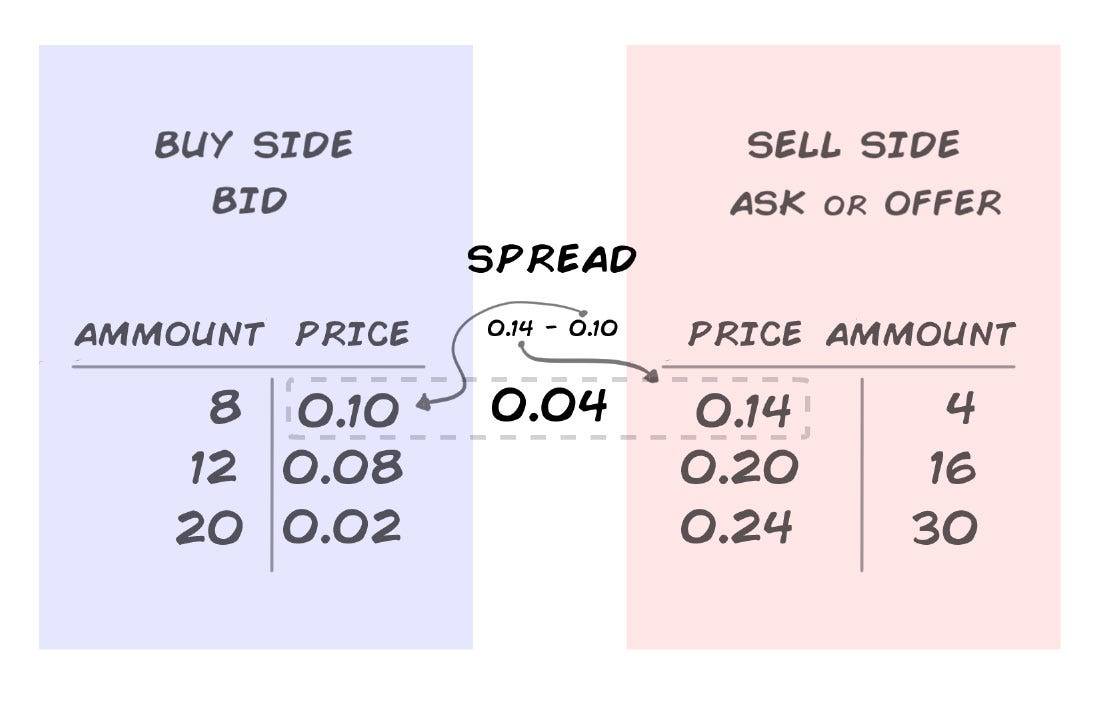

The forex spread also called the bid-ask spread is the difference between the bid and the ask prices for a specified currency pair. A spread is simply the price difference between where a trader may buy or sell an underlying asset. The forex spread represents two prices.

Forex brokers will quote you two different prices for a currency pair. Spreads costs and calculations. Floating spread is a completely market phenomenon and most of all interbank relations are characterized by it.

In fact this is a direct initial loss for the trader which should be covered in the process of further trading. Spread is the difference between the selling and buying prices of an asset. For currency pairs involving the Japanese Yen a pip is 001.

The difference between these two prices is known as the spread. So you are taking the difference between the Bid and Ask which gives you the Spread. This difference in the terms of Pips between the exchange rates of the concerned currency pairs is called the Spread or Forex Spreads for that currency pair.

Spread in Forex PDF Explained. The brokers make money by selling a currency to the traders for more than what they pay to buy it. Trading Forex carries a high level of risk.

Bid means the exchange ratio that is applied for a customer who is willing to buy with highest price. The last large number in the image below is a 3 and a 4. Brokers can add to or widen their bid-ask spread meaning an investor.

What is a spread in forex trading. Spreads are the difference between the bid price and the ask price of a currency pair. The brokers also make money by buying a currency from the traders for less.

Spread is in simple terms a sort of commission that brokers and specialists are able to collect on every forex trade. All the major foreign exchange currency pairs are always low in comparison with emerging currency pairs. To explain what does spread in forex mean I will commence with a practical business example.

It represents the difference between the selling and buying prices of particular currencies. When trading forex or any other asset via a CFD trading or spread betting account you pay the entire spread upfront. Spread is one of the key terms in the Forex market.

Forex brokers will quote you two different prices for a currency pair. Lets give an example on the popular EURUSD pair with a hypothetical quote of 1115211156. In the Forex and other financial markets the spread is the difference between the purchase price and the sale price of an asset.

If you are trading with a micro lot 001 010 USD and your spread is 1. The spreads are changeable so spread management strategy has also to be adaptable enough to fit market movements. Your spread cost would be 1 pip X 01 equals 010 USD.

The second is the ask price which is the price that you can buy the base currency. That alternative method is the commission. It can be calculated by adding the ask and bid prices and then dividing the sum by two.

Also known as the bidask spread. Thus along with the usual trading accounts with floating spread a number of companies offer clients so-called ECN accounts. Different brokers offer different spreads for different.

The buying bid price for a given currency pair and the selling ask price. The bid and ask price. The spread in Forex is considered one of the best options for both brokers and traders but it doesnt mean that there is no alternative method for it.

With the business point of view brokers have to make money against their services. The bid is the price at which you can SELL the base currency. The Forex Spread Meaning.

Every market has a spread and so does forex. Ad Trade with low spreads from just 08 points. The first is the bid price which is the price that you can sell the base currency.

EURUSD is priced at 11500 the broker will offer it for 11501 to buy or sell at 11499. The forex traders and dealers are aware that different companies and. In the above example the difference in the ask and bid prices of 12609 and 12607 is 2 pips and hence we can say that the spread for EURUSD is 2 pips.

Forex spread betting is a category of spread betting that involves taking a bet on the price movement of currency pairs. Floating spread on Forex and CFD markets is a constantly changing value between Ask and Bid prices. The Bid-Ask Spread Defined.

From the difference in the currency value. There is also a concept of zero spread forex in which the price difference and commission of the broker is zero. Forex lot size meaning.

Its called bid-ask spread. This commission is passed on to you the trader where it translates into the difference between the bid sell price and the ask buy price of a given currency pair. Also known as the bidask spread.

Ask means the. The bid and ask price. You will notice that there is a slight difference between the two prices.

Usually the Forex spread is how the broker companies make money. The trading price for any currency pair is expressed by. A spread is measured in pipsa unit of measurement that is equal to 00001 for most currency pairs.

Before diving into details I have to mention that there is a synonym word for this difference. Traders pay a certain price to buy the currency and have to sell it for less if they want to sell back it right away. The spread is how no commission brokers make their money.

Its usually very different depending on the broker you are trading with but it doesnt mean spreads and commissions cant be compared. Like any other market youll find spread in the Forex market. Spread in forex decides how much profit or loss a foreign exchange trader will get.

Spreads are the most common way that brokerages make a profit. America were turning forex trading on its head with low spreads and exceptional tools. The forex spread is the difference between a forex brokers sell rate and buy rate when exchanging or trading currencies.

The actual cost is just the spread times your lots you are trading with. Spread is the difference between a Bid and the Ask prices of each currency from a currency pair. The ask is the price at which you can BUY the base currency.

A spread is also the easiest way for many brokers to get compensated for each transaction the customer makes through their trading platforms. Spread is the difference between the Bid selling price and the Ask buying price. For example if a dealer is willing to sell a certain number of units of a given currency for the equivalent of US150 whereas a trader is only willing to buy a number of the currency units for US100 the midpoint price of the foreign exchange spread.

For a simple analogy consider that when you purchase a brand-new car you pay. Your Forex broker will give you two different prices for a currency pair. A spread is simply defined as the price difference between where a trader may purchase or sell an underlying asset.

The bid is the price at which you can SELL the base currency. Or simpler BidAsk spread. A company offering currency spread betting usually quotes two prices the.

This compares to the commission paid when trading share CFDs which is paid both when entering. Spread is the difference between the exchange rate that a forex broker sells a currency and the rate at which the broker buys the currency. The spread is how no commission brokers make their money.

The difference between these two prices is known as the spread.

What Spreads Mean For Traders Ig Us

Forex Spread What Is The Spread In Forex And How Do You Calculate It Ig Uk

Forex Spreads Trading Strategies Tips

What Does A Forex Spread Tell Traders

What Is Spread In Forex Currency Pairs General Mql5 Programming Forum

Bid Ask Spread Definition Forexpedia By Babypips Com

What Does A Forex Spread Tell Traders

What Is The Spread Forex Training Courses Plan B Trading Youtube

Forex Spread What Is The Spread In Forex And How Do You Calculate It Ig Uk

Forex Trading Academy Best Educational Provider Axiory Global

Foreign Exchange Spread Learn How To Calculate The Forex Spread

Understanding Spreads In Trading With Cryptocurrencies By Keno Leon Medium

What Is A Spread The Definition And Its Role In Forex Trading

What Is The Forex Broker S Order Execution Quality Babypips Com

Ask Definition Forexpedia By Babypips Com

What Are Fixed And Variable Spreads Andyw